House of Companies offers a comprehensive Entity Management Service, catering to both EU and non-EU nations, including the submission of corporate tax returns in Cyprus. Our service ensures that your company remains compliant with all local tax regulations, allowing you to focus on your core business activities.

House of Companies offers an efficient and reliable Entity Management Service, providing seamless corporate tax return submissions in Cyprus for both EU and non-EU countries. Our service leverages online tax portals to ensure compliance and ease of use.

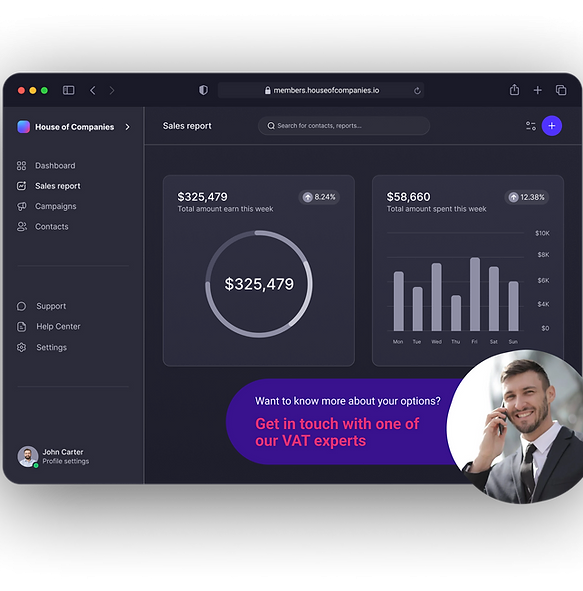

Once your corporate tax return is filed, you can use Entity Management to further run & grow your company!

"House of Companies made registering a local branch in the EU a piece of cake. No accountant needed!"

James Franco

James Franco"Their online tax portals for Cyprus are incredibly efficient. I saved so much time and avoided penalties!"

Sophia Martinez

Sophia Martinez"With House of Companies, managing my corporate tax returns across multiple countries has never been easier. Highly recommend!"

Liam Chen

Liam ChenHouse of Companies provides full facilitation by an International Tax Officer in Cyprus, ensuring your business complies with all local and international tax regulations. Our expert officers handle everything from tax planning to filing, offering a seamless experience.

Our Entity Management Service is designed to cater to both EU and non-EU countries, providing tailored solutions for your specific needs. With our comprehensive support, you can focus on your business while we manage your tax obligations efficiently.

Choose House of Companies for professional and reliable tax facilitation services. Our commitment to excellence ensures that your corporate tax matters are handled with precision and care.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!