Get Free Demo to our Portal to Manage your Entity

or Start a Local Business.

Starting a business in Cyprus offers numerous advantages, including a strategic location, favorable tax regime, and a business-friendly environment. Whether you are an EU or non-EU resident, Cyprus provides a streamlined process for company formation through platforms like House of Companies' Entity Management. This service ensures that all legal and administrative requirements are met, making it easier for entrepreneurs to establish their businesses efficiently. Additionally, Cyprus offers specialized services for non-residents, ensuring comprehensive support tailored to diverse client needs.

Choosing the right business structure is crucial for the success of your venture in Cyprus. The most common structures include Sole Proprietorship, Partnership, Limited Liability Company (LLC), and Public Limited Company (PLC). Each structure has its own legal and tax implications, so it's essential to select one that aligns with your business goals and operational needs. For instance, an LLC is popular due to its limited liability protection and flexibility, while a PLC is suitable for larger enterprises looking to raise capital through public offerings. Understanding these options and their benefits can help you make an informed decision, setting a solid foundation for your business in Cyprus.

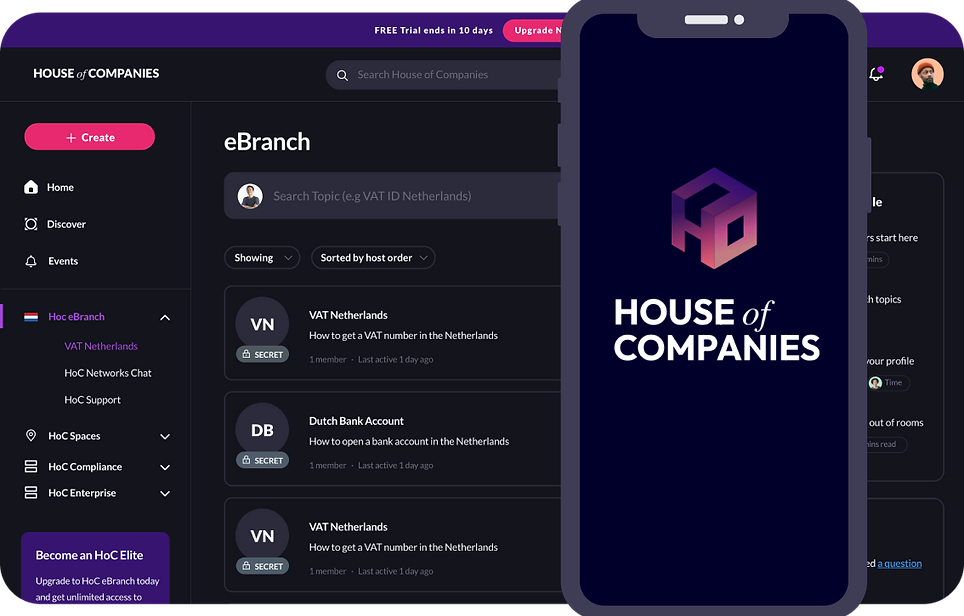

Our Entity Management service, designed to streamline the process of registering a company in Cyprus. Whether you're based in Germany, another EU country, or a non-EU nation, our platform caters to your needs, offering specialized services for non-residents. From selecting the right business structure to navigating legal requirements, our comprehensive support ensures a seamless setup. Our user-friendly interface provides real-time updates and expert guidance, allowing you to focus on your business goals while we handle the complexities.

Our service simplifies every step, from registering your company name and preparing necessary documentation to submitting your application and obtaining required licenses. We also assist in opening a corporate bank account and completing tax registration, ensuring full compliance with local regulations. Join the growing number of entrepreneurs who have successfully launched their ventures in Cyprus with our trusted platform.

Cyprus offers a wide array of legal entity options to suit the diverse needs of entrepreneurs and businesses. Whether you're looking to establish a sole proprietorship, partnership, or limited liability company (LLC), our Entity Management Service is here to guide you through every step of the process.

We understand that each business is unique, and our tailored solutions ensure that you choose the right structure to maximize your potential and achieve your goals. Our expert team provides comprehensive support, from initial consultation to full compliance with local regulations, making the setup process seamless and efficient.

At our core, we are committed to delivering professional and personalized service to clients worldwide. Our platform is designed to cater to both EU and non-EU entrepreneurs, offering specialized assistance for non-residents. With our real-time updates and expert guidance.

Registering a company in Cyprus offers a strategic advantage for both residents and non-residents looking to establish a business in a thriving European market. Our Entity Management Service is designed to simplify this process, providing you with a comprehensive overview of the various business structures available.

Whether you are considering a sole proprietorship, partnership, or limited liability company (LLC), we offer expert guidance to help you choose the best structure that aligns with your business goals and operational needs. For non-residents, our specialized services ensure compliance with local regulations, making the setup process seamless and efficient.

We are committed to delivering professional and personalized support to meet the diverse needs of our clients worldwide. Our platform caters to entrepreneurs from both EU and non-EU countries, offering real-time updates and expert advice throughout the registration process.

With our Entity Management Service, you can confidently navigate the complexities of establishing a business in Cyprus, knowing that every detail is handled with precision and care. Join the many successful businesses that have leveraged our services to expand their global footprint and thrive in the dynamic Cypriot market.

Selecting the appropriate legal structure for your global enterprise is a critical decision that can impact your business's operational efficiency, tax obligations, and legal responsibilities. The right structure will depend on various factors, including the nature of your business, the level of liability you are willing to assume, and your long-term strategic goals.

Common Legal Structures

Sole Proprietorship

Description: Owned and operated by a single individual.

Advantages: Simple to set up, complete control, and minimal regulatory requirements.

Disadvantages: Unlimited personal liability, limited capital raising options.

Partnership

Description: Owned by two or more individuals.

Advantages: Shared responsibilities, combined skills and resources.

Disadvantages: Unlimited liability for general partners, potential for conflicts.

Limited Liability Company (LLC)

Description: A hybrid structure offering limited liability protection.

Advantages: Limited liability for owners, flexible management structure, tax benefits.

Disadvantages: More complex to set up than sole proprietorships or partnerships, varying regulations by country.

Public Limited Company (PLC)

Description: Suitable for larger enterprises looking to raise capital through public offerings.

Advantages: Ability to raise significant capital, limited liability for shareholders.

Disadvantages: Extensive regulatory requirements, higher setup and maintenance costs.

Factors to Consider

At House of Companies, we offer expert guidance to help you choose the best structure that aligns with your business goals and operational needs. Our Entity Management Service simplifies the process, providing you with a comprehensive overview of the various business structures available. For non-residents, our specialized services ensure compliance with local regulations, making the setup process seamless and efficient.

Setting up your company in Cyprus with our Entity Management Service is a streamlined and efficient process, designed to cater to clients worldwide, including those from non-EU countries. Our service, "How Fast Can I Set Up My Company in Cyprus?" ensures that you can establish your business swiftly and with minimal hassle.

Cyprus offers a variety of business structures, such as private limited companies, public limited companies, and sole proprietorships, each with its own set of requirements and benefits. Our expert team will guide you through selecting the most suitable structure for your needs, gathering the necessary documentation, and completing all required registrations. Typically, the entire process can take anywhere from a few days to a couple of weeks, depending on the type of business and the completeness of your documentation.

We handle everything from initial consultation to final registration, ensuring your company is compliant and ready to operate. With our comprehensive support, you can focus on growing your business while we take care of the complexities. Experience the ease and speed of setting up your company in Cyprus with our professional and dedicated service.

Choosing the perfect legal structure for your global business is a critical decision that can significantly impact your operations, tax obligations, and overall success. The right structure depends on various factors, including the nature of your business, the countries you operate in, and your long-term goals. One common option is the Sole Proprietorship, which is simple to set up and offers complete control to the owner. However, it comes with unlimited liability, meaning personal assets are at risk if the business incurs debt.

For businesses with multiple owners, a Partnership might be suitable. Partnerships can be either General Partnerships (GP), where all partners share unlimited liability, or Limited Partnerships (LP), where some partners have limited liability. This structure allows for shared responsibility and resources but requires a clear agreement to avoid conflicts.

A Limited Liability Company (LLC) is another popular choice, providing limited liability protection while offering flexibility in management and profit distribution. LLCs are particularly advantageous for small to medium-sized enterprises looking to protect personal assets without the complexities of a corporation.

For larger businesses aiming to raise capital from the public, a Corporation might be the best fit. Corporations offer limited liability, perpetual existence, and the ability to issue shares. However, they are subject to more stringent regulatory requirements and higher administrative costs.

Another option for global businesses is establishing a Branch Office in a foreign country. This allows a company to operate in a new market without creating a separate legal entity, though it may expose the parent company to liability.

Finally, an Offshore Company can provide tax benefits and confidentiality for businesses operating internationally. However, it is essential to comply with local regulations and avoid any activities that could be perceived as tax evasion.

In conclusion, finding the perfect legal structure for your global business involves careful consideration of your specific needs and objectives. Consulting with legal and financial experts can help ensure you make an informed decision that supports your business's growth and sustainability.

Establishing a company in Cyprus as a non-resident can be a game-changer for your global business ambitions. At House of Companies, we understand that navigating the complexities of international business can be challenging, which is why our Entity Management platform is designed to simplify the process for both EU and non-EU entrepreneurs.

When considering setting up a business in Cyprus, non-residents should be aware of several key factors. Firstly, Cyprus offers a highly favorable tax regime, including one of the lowest corporate tax rates in the EU at just 12.5%. This makes it an attractive destination for businesses looking to optimize their tax obligations. Additionally, Cyprus has an extensive network of double tax treaties, which can further enhance your tax efficiency.

Another important consideration is the ease of doing business. Cyprus boasts a straightforward and transparent company registration process, which can be completed in a matter of days. Our platform provides step-by-step guidance, ensuring that you meet all legal requirements without unnecessary delays. Moreover, Cyprus's strategic location at the crossroads of Europe, Asia, and Africa makes it an ideal hub for international trade.

Non-residents should also consider the benefits of Cyprus's robust legal framework and business-friendly environment. The country offers strong protection for investors and a stable political climate, which are crucial for long-term business success. Furthermore, Cyprus's membership in the EU provides access to a vast single market, enhancing your business's growth potential.

At House of Companies, we are committed to empowering entrepreneurs by providing the tools and support needed to establish and manage their businesses in Cyprus. Our platform ensures that you can focus on what you do best—growing your business—while we handle the complexities of compliance and administration. Join us and take the first step towards global expansion with confidence.

Expanding your business to Cyprus has never been easier with House of Companies' "Start a Business" service. Whether you're an EU or non-EU entity, our Entity Management platform simplifies the process of opening a branch in this strategic location. Cyprus, known for its favorable tax regime and business-friendly environment, offers a gateway to European markets and beyond.

Opening a branch in Cyprus allows your business to operate seamlessly while benefiting from the country's robust legal framework and attractive incentives. Our platform guides you through every step, from initial registration to compliance with local regulations. You'll have access to expert advice and support, ensuring a smooth and efficient setup.

The process begins with securing a unique company name and drafting the necessary legal documents, including the Memorandum and Articles of Association. Our team assists in submitting these documents to the Department of Registrar of Companies and Official Receiver (DRCOR), ensuring all requirements are met. Once registered, we help you obtain a Tax Identification Number (TIN) and register for VAT if applicable.

Our comprehensive service also includes social insurance registration, ensuring your branch complies with employment regulations. With House of Companies, you can focus on growing your business while we handle the administrative tasks.

Choosing Cyprus for your branch offers numerous advantages, including access to a skilled workforce, excellent infrastructure, and a strategic location at the crossroads of Europe, Asia, and Africa. Our platform ensures that your expansion is not only possible but also straightforward and efficient.

Cyprus is a prime destination for entrepreneurs looking to establish a business, thanks to its favorable tax regime, strategic location, and business-friendly environment. For non-residents, understanding the various legal entities available is crucial to making an informed decision. Here’s a comprehensive look at the different types of business structures you can form in Cyprus.

Sole Proprietorship: This is the simplest form of business entity, owned and operated by a single individual. It offers complete control but comes with unlimited liability, meaning personal assets are at risk if the business incurs debt.

Partnership: This structure involves two or more individuals sharing ownership. There are two types: General Partnership (GP), where all partners have unlimited liability, and Limited Partnership (LP), where some partners have limited liability. Partnerships allow for shared responsibility and resources but require a clear agreement to avoid conflicts.

Private Limited Company (Ltd): A popular choice for small to medium-sized businesses, an Ltd offers limited liability protection and easier access to capital. It is a separate legal entity, meaning personal assets are protected, but it requires more regulatory compliance and higher setup costs.

Public Limited Company (PLC): Ideal for larger businesses looking to raise capital from the public, a PLC can issue shares to the public and offers limited liability to its shareholders. However, it is subject to stricter regulatory requirements and higher operational costs.

Branch Office: Non-residents can establish a branch of their foreign company in Cyprus. This allows them to operate in the Cypriot market without forming a separate legal entity, though it ties the branch’s liabilities to the parent company.

Offshore Company: This entity is incorporated in Cyprus but conducts business outside the country. It offers significant tax benefits and confidentiality, making it an attractive option for international operations, though it faces restrictions on local business activities.

Choosing the right legal structure is a critical step in setting up your business in Cyprus. Each entity has its own advantages and considerations, so it’s essential to evaluate your specific needs and objectives. House of Companies provides personalized guidance through our Entity Management platform, helping you navigate these options and make informed decisions.

Sign up by completing the form below.

Creating the Articles of Association is a crucial step in establishing your business in Cyprus, and our Entity Management platform is here to make the process seamless and stress-free. Imagine having a comprehensive guide that not only simplifies the legal jargon but also ensures that your business is set up for success from day one. Our platform is designed to cater to the unique needs of global entrepreneurs, providing you with the tools and support necessary to draft precise and compliant Articles of Association.

Whether you're a startup or an established business looking to expand into Cyprus, our service ensures that every detail is meticulously handled. The Articles of Association outline the rules and regulations governing your company, including the roles and responsibilities of directors and shareholders, the process for issuing shares, and the procedures for holding meetings. These foundational documents are essential for maintaining transparency and accountability within your organization.

Our Entity Management platform offers a user-friendly interface that guides you through each step of the drafting process. With expert templates and customizable options, you can create documents that reflect your business's unique vision and operational needs. Additionally, our platform provides real-time updates and compliance checks, ensuring that your Articles of Association meet all legal requirements in Cyprus.

By choosing our service, you gain access to a wealth of knowledge and expertise, empowering you to focus on what you do best—growing your business. Let us handle the complexities of legal documentation, so you can confidently establish your presence in Cyprus and beyond.

Appointing directors and shareholders in Cyprus has never been easier, thanks to our comprehensive Entity Management platform. Whether you're setting up a new venture or expanding your existing operations, our platform streamlines the process, ensuring compliance and efficiency every step of the way. Imagine having the power to appoint key personnel with just a few clicks, all while maintaining full control and oversight of your business structure.

Our platform is designed to cater to the unique needs of global entrepreneurs, providing a seamless experience that saves you time and reduces administrative burdens. With our intuitive interface, you can easily manage appointments, track changes, and stay updated on all regulatory requirements. This means you can focus on what truly matters—growing your business and achieving your strategic goals.

By choosing our Entity Management platform, you're not just appointing directors and shareholders; you're partnering with a team of experts dedicated to your success. We offer personalized support and guidance, ensuring that every decision you make is informed and compliant with Cypriot laws. Empower your business with the right leadership and ownership structure, and watch your enterprise thrive in the dynamic Cypriot market.

Join countless other businesses who have trusted us to simplify their entity management processes. Experience the peace of mind that comes with knowing your appointments are handled professionally and efficiently. Start appointing directors and shareholders in Cyprus today, and take the first step towards a more organized and successful business future.

Opening a business bank account in Cyprus is a crucial step for any entrepreneur looking to establish or expand their operations in this strategic location. Cyprus offers a robust banking system with a range of services tailored to meet the needs of businesses, both local and international.

To open a business bank account in Cyprus, you will need to follow these steps:

Choose a Bank: Research and select a bank that offers the services and support your business requires. Major banks in Cyprus include Bank of Cyprus, Hellenic Bank, and Alpha Bank.

Prepare Documentation: Gather the necessary documents, which typically include:

Submit Application: Visit the bank in person or contact them to submit your application along with the required documents. Some banks may offer online application options.

Compliance and Due Diligence: The bank will conduct due diligence checks to ensure compliance with anti-money laundering (AML) regulations and other legal requirements. This process may involve providing additional information or documentation.

Account Approval and Activation: Once the bank has reviewed and approved your application, your business bank account will be opened. You will receive account details and can start using the account for your business transactions.

Opening a business bank account in Cyprus not only facilitates smooth financial operations but also enhances your business's credibility and trustworthiness. Ensure you choose a bank that aligns with your business needs and provides the necessary support for your growth and success.

Efficient management is key to the success of any business, and setting up your company in Cyprus offers numerous advantages that can help streamline your operations. Cyprus is known for its favorable business environment, strategic location, and robust legal framework, making it an ideal destination for both residents and non-residents looking to establish a business.

Benefits of Managing Your Company in Cyprus

Favorable Tax Regime: Cyprus offers one of the lowest corporate tax rates in the European Union at 12.5%. Additionally, there are numerous tax incentives and exemptions available, which can significantly reduce your tax burden.

Strategic Location: Situated at the crossroads of Europe, Asia, and Africa, Cyprus provides easy access to major markets, making it an excellent hub for international business.

Robust Legal Framework: Cyprus has a well-established legal system based on English common law, providing a reliable and transparent business environment.

Skilled Workforce: The country boasts a highly educated and multilingual workforce, which can enhance your company’s productivity and innovation.

Advanced Infrastructure: Cyprus offers modern infrastructure, including advanced telecommunications, transportation networks, and business facilities, supporting efficient business operations.

Establishing a company in Cyprus can be a swift process, typically taking around 2-4 weeks, depending on various factors such as the type of business structure and the efficiency in gathering required documentation. Here is a breakdown of the key steps and their estimated timelines:

Company Name Approval: This step involves submitting your desired company name to the Registrar of Companies for approval. It usually takes 1-3 days.

Preparation of Memorandum and Articles of Association: Once the company name is approved, the next step is to prepare the Memorandum and Articles of Association. This legal document outlines the company's structure and operations. This process typically takes 3-5 days.

Submission to the Registrar of Companies: After preparing the necessary documents, they are submitted to the Registrar of Companies for registration. The review and approval process usually takes 5-10 days.

Tax Identification Number (TIN) Registration: Upon successful registration, the company must obtain a Tax Identification Number from the tax authorities. This step usually takes 1-3 days.

VAT Registration (if applicable): If your company is expected to exceed the VAT threshold, you will need to register for VAT. This process typically takes 1-3 days.

Opening a Corporate Bank Account: Setting up a corporate bank account is essential for your business operations. This step can take 1-2 weeks, depending on the bank's requirements and procedures.

Obtaining Necessary Licenses and Permits: Depending on your industry, you may need specific licenses and permits to operate legally. The time required for this step varies based on the type of business and regulatory requirements.

With efficient planning and the right support, the entire process can be completed within approximately 2-4 weeks. Our Entity Management Service at House of Companies is designed to streamline these steps, ensuring a smooth and efficient setup.

Discover the advantages of registering your company in Cyprus with our comprehensive and cost-effective Entity Management services. Our platform simplifies the entire process, ensuring compliance and efficiency while keeping costs transparent and manageable. With our expertise, you can enjoy the strategic benefits of a Cyprus-based business, including favorable tax regimes and a robust legal framework, without the burden of excessive fees.

Our services cater to both EU and non-EU countries, with a particular focus on German businesses looking to expand globally. We provide detailed guidance on every step of the registration process, from name approval to obtaining necessary certificates and opening a business bank account. Our competitive pricing includes all essential fees, such as incorporation, legal, and annual maintenance costs, ensuring you have a clear understanding of your investment from the start.

Choose our Entity Management platform to experience seamless company registration in Cyprus, backed by expert support and a commitment to your business's success.

Registering with the Cyprus Business Register is a crucial step for any business looking to establish a presence in Cyprus. The process begins with selecting a unique company name and obtaining approval from the Registrar of Companies. Once the name is approved, you will need to prepare and submit the necessary incorporation documents, including the Memorandum and Articles of Association, which outline the company's structure and operational guidelines. Additionally, you must provide details about the company's directors, shareholders, and registered office address in Cyprus.

After submitting the required documents and paying the registration fee, your company will be officially registered, and you will receive a Certificate of Incorporation. This certificate is essential for all formal business activities and serves as proof of your company's legal existence in Cyprus.

In addition to registering with the Cyprus Business Register, you must also register with the Cyprus Tax Department. Upon registration with the Business Register, your details are automatically shared with the Tax Department. You will receive a Tax Identification Number (TIN) and, if applicable, a VAT number. These numbers are crucial for managing your tax obligations in Cyprus, including filing tax returns and paying taxes.

The Cyprus tax system offers numerous advantages for businesses, making it an attractive destination for companies looking to optimize their tax liabilities while benefiting from a favorable regulatory environment. Here are some key benefits:

1. Competitive Corporate Tax Rate

Cyprus boasts one of the lowest corporate tax rates in the European Union at 12.5%. This competitive rate applies to the worldwide income of resident companies, providing significant tax savings compared to other jurisdictions.

2. Extensive Network of Double Tax Treaties

Cyprus has established an extensive network of double tax treaties with over 60 countries, including major economies like the United States, United Kingdom, and Germany. These treaties help to avoid double taxation on income earned in multiple countries, making cross-border operations more tax-efficient.

3. Tax Exemptions and Incentives

The Cyprus tax system offers various exemptions and incentives to encourage business growth and investment. For instance, there are no withholding taxes on dividends, interest, and royalties paid to non-residents. Additionally, profits from the sale of securities are exempt from tax, and there are generous allowances for research and development (R&D) expenditures.

4. Intellectual Property (IP) Regime

Cyprus provides an attractive IP regime, offering an 80% exemption on qualifying profits from the exploitation of intellectual property. This regime significantly reduces the effective tax rate on IP-related income, making Cyprus a favorable location for innovation-driven businesses.

5. VAT Benefits

The standard VAT rate in Cyprus is 19%, with reduced rates of 5% and 9% applicable to certain goods and services. Additionally, Cyprus offers VAT exemptions for international transactions, which can further reduce the tax burden for businesses engaged in cross-border trade.

6. Personal Tax Benefits

The personal income tax system in Cyprus is progressive, with rates ranging from 0% to 35%. There are also various allowances and deductions available, such as for contributions to social insurance, pension funds, and life insurance premiums. These benefits make Cyprus an attractive location for both businesses and their employees.

7. Simplified Compliance and Administration

The Cyprus tax system is known for its simplicity and efficiency. The regulatory framework is business-friendly, with straightforward compliance requirements and administrative procedures. This reduces the administrative burden on companies, allowing them to focus on their core business activities.

8. Strategic Location and EU Membership

Cyprus's strategic location at the crossroads of Europe, Asia, and Africa, combined with its EU membership, provides businesses with access to a large and diverse market. This enhances the potential for growth and expansion while benefiting from the stability and regulatory framework of the European Union.

In conclusion, the Cyprus tax system offers a range of benefits that make it an attractive destination for businesses seeking to optimize their tax liabilities and expand their operations. With its competitive tax rates, extensive double tax treaty network, and favorable regulatory environment, Cyprus provides a compelling proposition for global businesses.

The Cyprus tax system offers numerous advantages for businesses, making it an attractive destination for companies looking to optimize their tax liabilities while benefiting from a favorable regulatory environment. Here are some key benefits:

Cyprus boasts one of the lowest corporate tax rates in the European Union at 12.5%. This competitive rate applies to the worldwide income of resident companies, providing significant tax savings compared to other jurisdictions.

Cyprus has established an extensive network of double tax treaties with over 60 countries, including major economies like the United States, United Kingdom, and Germany. These treaties help to avoid double taxation on income earned in multiple countries, making cross-border operations more tax-efficient.

The Cyprus tax system offers various exemptions and incentives to encourage business growth and investment. For instance, there are no withholding taxes on dividends, interest, and royalties paid to non-residents. Additionally, profits from the sale of securities are exempt from tax, and there are generous allowances for research and development (R&D) expenditures.

Cyprus provides an attractive IP regime, offering an 80% exemption on qualifying profits from the exploitation of intellectual property. This regime significantly reduces the effective tax rate on IP-related income, making Cyprus a favorable location for innovation-driven businesses.

The standard VAT rate in Cyprus is 19%, with reduced rates of 5% and 9% applicable to certain goods and services. Additionally, Cyprus offers VAT exemptions for international transactions, which can further reduce the tax burden for businesses engaged in cross-border trade.

The personal income tax system in Cyprus is progressive, with rates ranging from 0% to 35%. There are also various allowances and deductions available, such as for contributions to social insurance, pension funds, and life insurance premiums. These benefits make Cyprus an attractive location for both businesses and their employees.

Cyprus's strategic location at the crossroads of Europe, Asia, and Africa, combined with its EU membership, provides businesses with access to a large and diverse market. This enhances the potential for growth and expansion while benefiting from the stability and regulatory framework of the European Union.

1. Competitive Corporate Tax Rate

Cyprus offers one of the lowest corporate tax rates in the European Union at 12.5%. This competitive rate applies to the worldwide income of resident companies, providing significant tax savings for businesses.

2. Intellectual Property (IP) Tax Regime

Cyprus has an attractive IP tax regime that allows an 80% exemption on qualifying profits from the exploitation of intellectual property. This significantly reduces the effective tax rate on IP-related income, encouraging innovation and the development of new technologies.

3. Notional Interest Deduction (NID)

Cyprus provides a Notional Interest Deduction on new equity, which allows companies to deduct a notional interest expense on equity invested in the business. This reduces the taxable base and encourages investment and capitalization of companies.

4. Tax Exemptions on Dividends

Dividends received by a Cyprus resident company from another foreign company are generally exempt from tax, provided certain conditions are met. This exemption helps to avoid double taxation and encourages the repatriation of profits.

5. No Withholding Taxes

Cyprus does not impose withholding taxes on dividends, interest, and royalties paid to non-residents. This makes Cyprus an attractive jurisdiction for holding companies and international business structures.

6. Double Tax Treaties

Cyprus has an extensive network of double tax treaties with over 60 countries, including major economies. These treaties help to avoid double taxation and provide tax relief on cross-border income, making international operations more tax-efficient.

7. VAT Benefits

The standard VAT rate in Cyprus is 19%, with reduced rates of 5% and 9% applicable to certain goods and services. Additionally, Cyprus offers VAT exemptions for international transactions, which can further reduce the tax burden for businesses engaged in cross-border trade.

Maintain and File Accurate Financial Records

All companies registered in Cyprus are required to maintain accurate and up-to-date financial records. These records must reflect all transactions and financial activities of the company, ensuring transparency and accountability.

Prepare Annual Financial Statements

Companies must prepare annual financial statements in accordance with International Financial Reporting Standards (IFRS). These statements include the balance sheet, income statement, statement of changes in equity, cash flow statement, and notes to the financial statements. The financial statements must provide a true and fair view of the company's financial position and performance.

Fulfill Statutory Reporting Obligations with the Relevant Authorities

Companies in Cyprus are required to fulfill statutory reporting obligations by submitting their annual financial statements to the Registrar of Companies and the Cyprus Tax Department. This ensures compliance with local regulations and provides stakeholders with reliable financial information.

Compliance with the Cyprus Companies Law and IFRS

The preparation and presentation of financial statements must comply with the Cyprus Companies Law, Cap. 113, and International Financial Reporting Standards (IFRS). This ensures that the financial statements are consistent with international best practices and provide a high level of transparency.

Small Companies May Be Exempt from Audits

Small companies in Cyprus may be exempt from the requirement to have their financial statements audited. To qualify as a small company, an entity must meet at least two of the following criteria:

Medium and Large Entities Are Required to Undergo Annual Audits

Medium and large entities are required to undergo annual audits by a licensed external auditor. The audit must be conducted in accordance with International Standards on Auditing (ISA). The auditor’s report is included in the annual financial statements submitted to the authorities.

Foreign Residents Establishing a Company in Cyprus

Foreign residents establishing a company in Cyprus must adhere to the same financial reporting and audit requirements as domestic companies. This includes maintaining accurate financial records, preparing annual financial statements, and undergoing audits where applicable. Compliance with these requirements ensures that foreign-owned companies operate transparently and in accordance with Cypriot laws and regulations.

In summary, Cyprus has a robust framework for financial reporting and audit requirements designed to promote transparency, accountability, and compliance with international standards. By adhering to these regulations, companies can enhance their credibility, attract investors, and ensure compliance with both local and international standards.

Hiring personnel in Cyprus is relatively straightforward, thanks to the country's business-friendly environment and well-regulated labor market. Here are some key points to consider:

1. Availability of Skilled Workforce

Cyprus has a well-educated and multilingual workforce, with many professionals fluent in English and other European languages. The country has a strong emphasis on education, producing graduates with skills in various fields, including finance, technology, and tourism.

2. Employment Regulations

Cyprus follows EU labor laws, ensuring fair treatment and protection for employees. Employers must comply with regulations regarding working hours, minimum wage, health and safety standards, and social insurance contributions.

3. Recruitment Process

The recruitment process in Cyprus is similar to other EU countries. Employers can advertise job vacancies through various channels, including online job portals, recruitment agencies, and local newspapers. The use of professional networks and social media platforms like LinkedIn is also common.

4. Work Permits and Visas

For non-EU nationals, obtaining a work permit is necessary. The process involves submitting an application to the Civil Registry and Migration Department, along with supporting documents such as a job offer, proof of qualifications, and a clean criminal record. The process is generally efficient, but it is advisable to start early to avoid delays.

5. Employment Contracts

Employment contracts in Cyprus must be in writing and should outline the terms and conditions of employment, including job responsibilities, salary, working hours, and benefits. Both fixed-term and indefinite contracts are common, and probation periods are typically included.

6. Social Insurance and Benefits

Employers are required to register their employees with the Social Insurance Services and make contributions to social insurance, which covers benefits such as healthcare, pensions, and unemployment benefits. The contribution rates are shared between the employer and the employee.

7. Termination of Employment

Termination of employment in Cyprus must comply with the Termination of Employment Law, which provides guidelines on notice periods, severance pay, and valid reasons for dismissal. Both employers and employees have rights and obligations to ensure fair and lawful termination procedures.

8. Support Services

There are numerous recruitment agencies and HR service providers in Cyprus that can assist with the hiring process, including candidate sourcing, screening, and compliance with labor laws. These services can be particularly useful for foreign companies unfamiliar with local regulations.

Cyprus offers robust intellectual property (IP) protection, aligning with international standards and European Union regulations. The country has implemented comprehensive laws and regulations to safeguard various forms of IP, including patents, trademarks, copyrights, and industrial designs. Cyprus is a signatory to several international treaties and agreements, such as the Paris Convention for the Protection of Industrial Property, the Berne Convention for the Protection of Literary and Artistic Works, and the World Intellectual Property Organization (WIPO) treaties. These agreements ensure that IP rights registered in Cyprus are recognized and protected globally, providing a secure environment for businesses and innovators.

The Cyprus IP regime offers significant tax incentives, particularly through the IP Box regime, which provides an 80% exemption on qualifying profits from the exploitation of IP assets. This regime significantly reduces the effective tax rate on IP-related income, making Cyprus an attractive destination for companies engaged in research, development, and innovation. Additionally, the legal framework in Cyprus ensures efficient enforcement of IP rights, with specialized courts and procedures in place to handle IP disputes. This strong protection and favorable tax environment encourage businesses to develop and commercialize their intellectual property in Cyprus, fostering innovation and economic growth.

Obtaining the necessary permits and licenses is a crucial step for businesses operating in Cyprus. The specific requirements depend on the nature of the business and the industry in which it operates. Common permits include business registration with the Department of Registrar of Companies and Official Receiver, obtaining a tax identification number from the Tax Department, and registering for VAT if the business's annual turnover exceeds the threshold. Additionally, businesses in regulated sectors such as finance, healthcare, and construction may require special licenses from relevant authorities, such as the Cyprus Securities and Exchange Commission (CySEC) for financial services or the Ministry of Health for healthcare-related businesses.

The process of obtaining permits and licenses in Cyprus is generally straightforward, supported by a well-organized regulatory framework. The government has implemented various measures to streamline administrative procedures, including online application systems and one-stop-shop services to facilitate business operations. Compliance with local regulations is essential to avoid legal issues and ensure smooth business operations. Entrepreneurs are advised to consult with legal and business advisors to navigate the specific requirements and ensure that all necessary permits and licenses are obtained in a timely manner. This proactive approach helps businesses establish a solid legal foundation and operate confidently within the Cypriot market.

Cyprus presents a compelling environment for businesses and entrepreneurs, offering a range of benefits from a favorable tax regime to robust intellectual property protection. The country's strategic location, coupled with its membership in the European Union, provides businesses with access to a vast market and a stable regulatory framework. The ease of hiring skilled personnel, straightforward permit and license procedures, and comprehensive financial reporting and audit requirements further enhance Cyprus's attractiveness as a business destination.

In addition to these advantages, Cyprus's commitment to aligning with international standards and its extensive network of double tax treaties make it an ideal hub for international operations. The proactive measures taken by the government to streamline administrative processes and provide incentives for innovation and investment underscore Cyprus's dedication to fostering a business-friendly environment. As a result, businesses operating in Cyprus can enjoy a supportive infrastructure that promotes growth, compliance, and long-term success.

1. What are the main benefits of starting a business in Cyprus?

Cyprus offers a favorable tax regime, strategic location, access to the EU market, robust IP protection, and a skilled, multilingual workforce.

2. What are the steps to register a company in Cyprus?

To register a company, you need to submit a company name approval request, prepare and file the necessary incorporation documents, and register with the Registrar of Companies.

3. What types of business entities can be established in Cyprus?

Common types of business entities include private limited companies, public limited companies, partnerships, and branches of foreign companies.

4. How long does it take to incorporate a company in Cyprus?

The incorporation process typically takes about 5-10 working days, depending on the complexity of the company structure and the completeness of the documentation.

5. What are the corporate tax rates in Cyprus?

The corporate tax rate in Cyprus is 12.5%, one of the lowest in the EU, with additional incentives available under the IP Box regime.

6. Are there any specific licenses required to operate a business in Cyprus?

The specific licenses required depend on the industry. Common licenses include business registration, tax identification, and sector-specific licenses for regulated industries like finance and healthcare.

7. What are the financial reporting requirements for companies in Cyprus?

Companies must prepare annual financial statements in accordance with IFRS and submit them to the Registrar of Companies and the Cyprus Tax Department.

8. Can foreign nationals own and manage businesses in Cyprus?

Yes, foreign nationals can own and manage businesses in Cyprus. They must comply with the same legal and regulatory requirements as local businesses.

9. What are the employment regulations for hiring staff in Cyprus?

Employers must comply with EU labor laws, including regulations on working hours, minimum wage, health and safety standards, and social insurance contributions.

10. What support services are available for new businesses in Cyprus?

There are numerous support services available, including business advisory services, legal and accounting firms, and government agencies that provide guidance on starting and running a business in Cyprus.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!