Cyprus offers a favorable tax system for businesses, including:

We can help ensure your business benefits from these tax advantages by providing expert tax planning, compliance, and advisory services.

In addition to filing taxes, your business will need to maintain compliance with a range of ongoing corporate requirements. These include:

Our team supports businesses in ensuring they meet these ongoing compliance requirements, from preparing annual returns to arranging for an external audit.

Cyprus has a thriving business ecosystem, offering numerous opportunities for collaboration and networking. Establishing connections with local suppliers, service providers, and potential clients is vital for gaining a strong foothold in the market. Engaging with business organizations such as the Cyprus Chamber of Commerce and Industry can provide access to a wide network of resources and opportunities.

Building local connections in Cyprus is crucial for several reasons:

Engaging with key business organizations can significantly benefit your business:

Participating in networking events and trade shows is an excellent way to build connections:

Business Conferences: Attending business conferences in Cyprus can help you meet industry leaders, potential partners, and clients.

Trade Fairs: Trade fairs provide a platform to showcase your products or services, meet suppliers, and explore new business opportunities.

Workshops and Seminars: These events offer learning opportunities and a chance to network with professionals in your industry.

We assist our clients in connecting with key local players and providing valuable insights into the Cyprus market:

Introductions to Local Suppliers and Service Providers: We facilitate introductions to reliable local suppliers and service providers, ensuring you have the resources needed to operate efficiently.

Market Research and Analysis: Our team conducts thorough market research to provide insights into the Cypriot market, helping you make informed business decisions.

Networking Opportunities: We organize and recommend networking events, trade shows, and business conferences that align with your industry and business goals.

Support from Business Organizations: We help you engage with key business organizations such as the CCCI, OEB, and CIPA, providing access to their resources and support services.

By leveraging our expertise and local connections, we help you navigate the Cypriot business ecosystem, ensuring your business establishes a strong presence and thrives in the market.

As your trusted partner, we provide comprehensive services to guide you through the Cyprus company setup process:

By partnering with us, you can focus on growing your business while we manage the complexities of Cyprus company formation and operations.

When setting up a business in Cyprus, understanding the country’s labor laws is critical, especially if you plan to hire employees. Cyprus has well-defined regulations to protect both employers and employees, ensuring a balanced and fair working environment. Key areas of concern for businesses include:

Cyprus law mandates written employment contracts for all employees. These contracts should outline:

The standard working week in Cyprus is typically 38 hours, but this can vary depending on the industry. Cyprus adheres to EU regulations concerning:

Although Cyprus does not have a statutory minimum wage for all sectors, certain industries have specific minimum wage regulations:

Employers are required to contribute to the national social insurance scheme, which covers:

Cyprus has stringent health and safety regulations to ensure a safe working environment:

Cyprus labor laws provide robust protections for employee rights:

We can assist in navigating Cyprus’ employment laws by offering comprehensive guidance on:

By leveraging our expertise, you can ensure that your business adheres to Cyprus’s labor laws, creating a compliant and productive workplace.

Stepping into the Cyprus business landscape offers numerous advantages for entrepreneurs. With its strategic location at the crossroads of Europe, Asia, and Africa, Cyprus serves as an ideal hub for international operations.

The country boasts one of the lowest corporate tax rates in Europe at 12.5%, making it an attractive destination for foreign investment. Additionally, Cyprus's membership in the European Union provides businesses with unrestricted access to the EU single market.

Cyprus's well-developed legal and regulatory framework ensures a secure environment for business operations. The island also offers high-quality professional services, including legal, accounting, and financial support.

Entrepreneurs can benefit from the streamlined process of registering a branch in Cyprus, which can be completed in as little as one day. Notably, a notary is not required for branch registration, simplifying the process further.

How about we discuss your choices?

Yes, non-residents can start a company in Cyprus. The country offers a straightforward process for foreign entrepreneurs to establish businesses, including options like limited liability companies (LLCs) and branch registrations.

Cyprus's favorable tax regime, strategic location, and access to the EU market make it an attractive destination for international business operations.

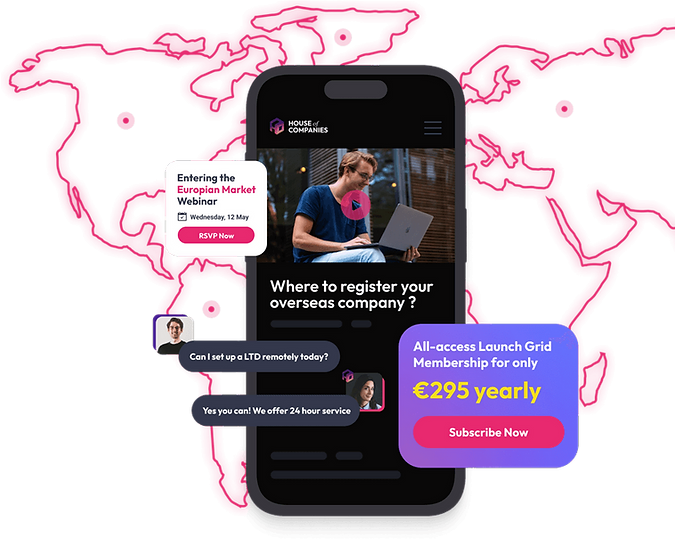

House of Companies provides comprehensive support to non-residents, ensuring a smooth registration process and compliance with local regulations.

How about we discuss your choices?

Choosing between a branch and a subsidiary in Cyprus depends on your business goals.

A branch is quicker to set up and allows for direct control from the parent company, but it doesn't offer separate legal liability.

A subsidiary, typically a limited liability company (LLC), provides legal independence and limited liability protection but involves more complex setup and compliance requirements.

Consider your operational needs and risk tolerance when making this decision.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!