At House of Companies, we specialize in providing comprehensive and expert tax and accounting services to non-resident individuals and businesses in Cyprus. Whether you are a foreign investor, entrepreneur, or company owner, our team of experts is ready to navigate the complexities of Cyprus’s tax regulations and ensure full compliance, so you can focus on growing your business globally.

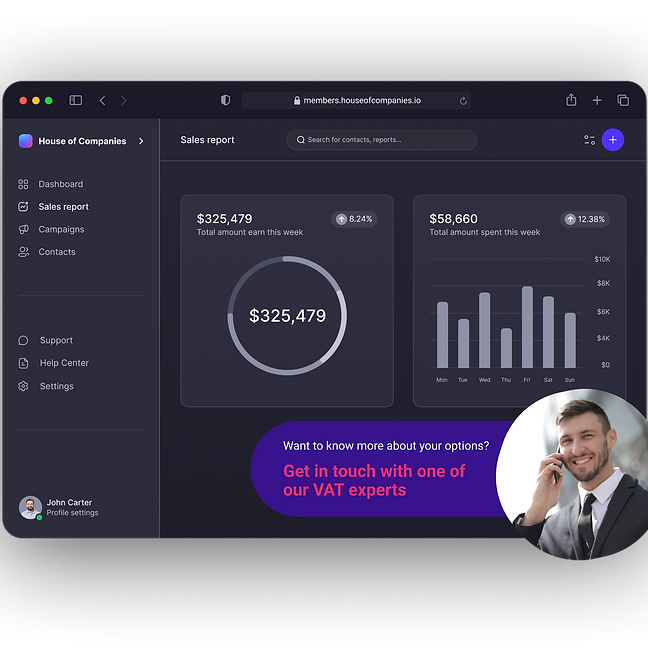

As a non-resident business or investor, managing your financial obligations can seem challenging. However, with House of Companies, we simplify bookkeeping by automating the process for you. Our innovative system allows you to submit documents, such as invoices, bank statements, and agreements (e.g., lease contracts), using a single platform. Our system processes all your financial data in real-time, providing you with instant access to your tax reports and ensuring that you meet all local compliance standards in Cyprus.

"I expected it to take about two quarters to generate turnover in Cyprus. Luckily, I didn’t have to spend any money on an accountant in the meantime, thanks to House of Companies!"

Global Hiring Manager

Global Hiring Manager"My Indian accountant drafts my VAT reports and submits the return using House of Companies’ entity management services. It’s been a game-changer."

Spice & Herb Exporter

Spice & Herb Exporter"The practical know-how from House of Companies made me feel confident in getting more involved in my own tax filing—and it worked!"

Tech Company

Tech CompanyYour situation may require the assistance of a local tax professional, given the constantly evolving nature of tax and accounting regulations in Cyprus. In certain cases, local accountants may be required by law.

If you need help filing your tax returns, House of Companies is here to assist you. You can send us your existing ledgers and VAT analysis, or instruct us to prepare them from scratch, ensuring that your compliance is thorough and meets Cyprus’s regulatory standards.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!